Financial Gymnastics: Summary of Recent Factors on Gold’s Price (July 2015)

In April 2020, GoldNews.com.au came under new management, articles published before this time, such as the below, may not reflect the views or opinions of the current GoldNews.com.au team.

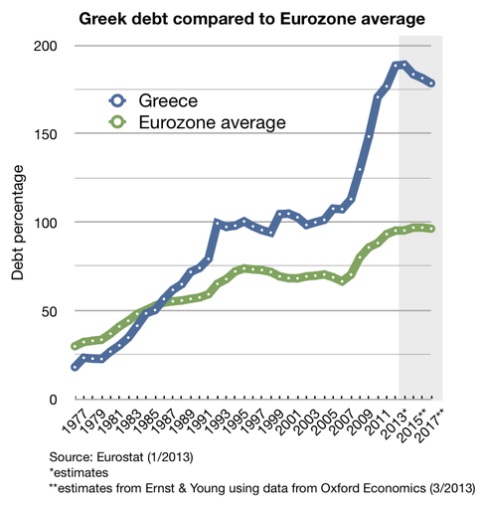

The entire financial system remains on the brink of collapse, the total national debt of nations have gone ballistic with most of the western world having public debts of over 100 %. America, Brazil, China, Britain and Canada are leading the debt ratios with trillions of dollars in debt, debts are rising faster than economic outputs that pave the way towards higher taxes and according to The Economist debt ratios of above 90 % represent unhealthy economies in general (The Economist, 2015). The increased volatility in markets across the globe, false breakouts, sharp moves to lower tiers have practically made markets senseless, and it is important to know that these are the big players in the market (Big players meaning, hedge fund managers for major corporations and governments) are wildly shaking the tree to ensure those clinging on for the ride let go before they prep for the rallies. All the events that are currently transpiring are pointing towards a precious metal market rally, although prices seem to be dipping ever since Greece was put in the spotlight, do not be too quick to jump the gun or pull the trigger and bail out, yes prices have the potential to go lower, forcing smaller market players to dump their gold stocks in order for the bigger players to scoop it up before they unleash the wave, be patient and the outcome might just surprise you in the coming weeks.

What is interesting about the chart is the fact that as soon as the Greek default was highlighted in the media, prices of gold started falling – slowly, indicating that the big market players are actually positioning for a buy while the smaller market players start dropping their holdings in gold due to the slide, our advice is to not fall prey to the market’s antics at this time while a major bottom is being founded and stick to your guns and preferably buy more gold related stocks – physical gold is even better for liquidation purposes when the market starts bulling. However, do be vigilant as when the prices hit resistance, be ready to bail out, or at least bail half your stocks out to be on the safe side and wait for the next wave if it comes, your leeway should not be more than 10 % of the price fall at the first resistance.

The Grexit Affair

The Greek Government and the ‘Troika’ which incidentally is a Russian term for ‘the group of three (the EC, the IMF and the ECB) are back in lime light, and based on media reports and responses from the Troika, questions have not been answered, but rather side-winded, one of those questions pertains to the gold reserves that Greece has, according to official statements Greece is supposedly to be in possession of 112.5 tons of gold which is worth close to 4 billion Euros (Kitco News, 2015), way above their defaulted payment of 1.6 billion Euros, all they needed to do was sell 47 tons of gold from their reserves to make the payment, however this did not happen only because, the new government do not want to be with the European Union any longer, the rationale behind this motivation is actually stark, by being in the EU, Greece became bankrupt. Another report by (Manly, 2015) indicated that the Greek gold reserves as of 2012 was at 147.6 tones and the fact that the 2012 annual report indicated that ““The largest part of gold holdings is kept in banks abroad” was indicative towards the fact that a certain amount of gold was already repatriated back to Greek just prior to 2012 when the country’s fiscal budget was fragile and deteriorating quite rapidly.

Greece was the tax evasion capital of the world and tax returns were lesser than 30,000 Euros annually and tax evasions actually cost the country about 20 – 30 billion Euros each year, a deficit that was not bolstered by trade which eventually amounted to 2/3 of its current deficit.

Based on these facts it is evident that the Greeks continued economic growth spanning for the last 3 decades was not due to trade surpluses, the country was actually practically borrowing its wealth and it had finally reached a point whereby the Greece is no longer able to borrow and pay its debts. The whereabouts of Greece’s gold reserves and the amount held in reserve is also shrouded in red tape. An economic crisis that would push the prices of gold up is inevitable and logically, keeping the gold reserves until the prices of gold rallies is actually a good option for Greece to re-establish its economy.

Leave a Reply